A chargeback is a right afforded to all credit and debit cardholders to reverse a transaction that is disputed by the consumer. If, for example, a consumer makes a payment with his debit or credit card and the goods or services received were not as advertised or were defective, then the consumer is entitled to a chargeback.

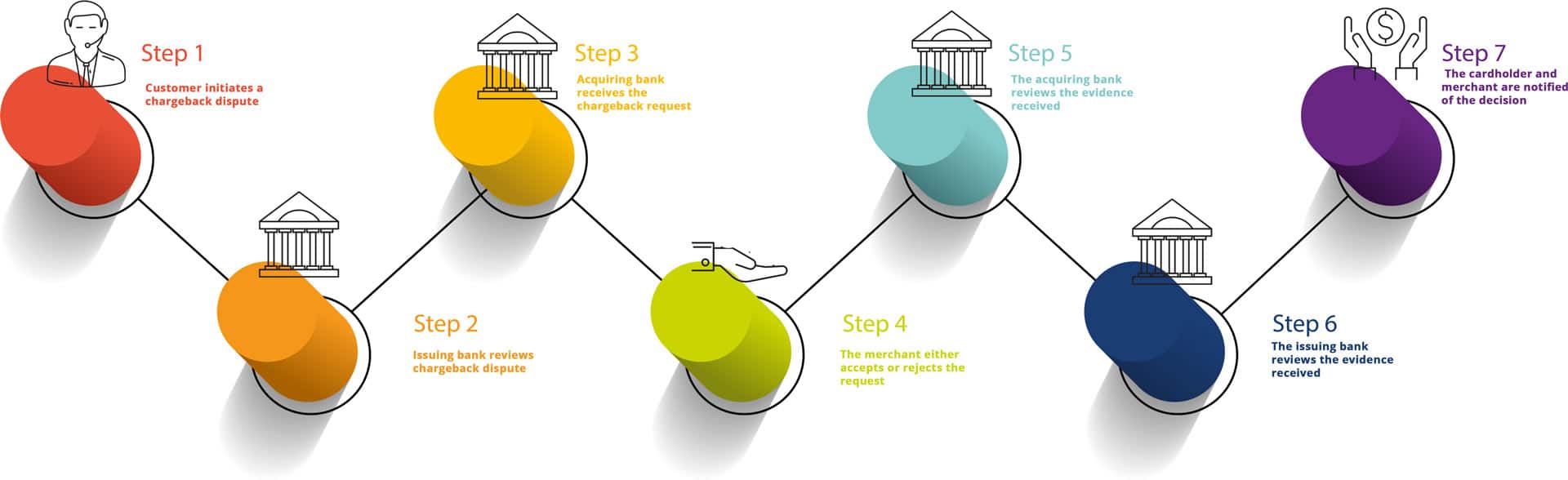

A successful chargeback will have the consumer’s bank (issuing bank) withdraw the funds paid into the merchant’s account (acquiring bank) and deposit them back into the consumer’s account.

In order to proceed with a chargeback, the consumer needs to present the necessary documentation that supports the claim. This includes proof that the goods or services provided were either defective or not as advertised, copies of the transaction history, reason codes for the chargeback and a supporting letter as to the reason for the request.

The information is then sent to the merchant’s bank and the merchant for review and comment. The merchant then has the opportunity to either accept or defend the chargeback request. Supporting evidence from the merchant will need to be sent should they decide to defend the transaction.

While the chargeback process may seem like a straightforward procedure, one needs to fully familiarize himself of the rules and regulations that govern issuing a chargeback through the banks. Incorrectly filed documentation, reason codes or evidence can result in a denied chargeback. You only have one chance at issuing a chargeback so full understanding of the process and compiling of data is critical to a successful chargeback.

With years of experience in finance, banking and the chargeback process, Chargebax is able to provide you with up-to-date information and tips on how to successfully initiate a chargeback with your bank.

If you are in need of an effective and professional fund recovery solution that includes a chargeback, contact Chargebax today and we will be happy to provide you with a free consultation and assessment of your case.