A chargeback is essentially the reversal of a charge made to your credit or debit card. Credit and debit card transactions are highly controlled and regulated in order to protect both consumers and merchants. Visa and MasterCard for example, have a set of terms and conditions that govern the use of their cards.

These terms and conditions govern the rights and responsibilities of the cardholder, their bank, the merchant and the merchant’s bank.

A consumer who has lost or had their card stolen, for example, can notify their bank to reverse any charges made. In addition, card holders are able to reverse an authorized charge for goods or services that were not received as advertised.

Chargebacks cover all transactions made with a credit and debit card

Step 1 – Customer initiates a dispute request over a transaction.

Step 2 – Issuing bank reviews dispute charge and send transaction to acquiring bank electronically

Step 3 – Acquiring bank receives the chargeback request, resolves the issue automatically or forwards it to the merchant

Step 4 – Merchant either accepts the chargeback request or rejects it by sending evidence to the acquiring bank

Step 5 – Acquiring bank reviews the evidence received from the merchant, ensure it meets the requirements before sending it to the issuing bank

Step 6 – Issuing bank reviews evidence received from the merchant and makes a decision on the chargeback request

Step 7 – Cardholder and merchant are notified of the decision where either party can initiate arbitration in the event that they disagree with the decision

The timeframe to issue a chargeback typically depends on the card companys’ terms and conditions. Generally, cardholders should advise their bank within 120 days from the date of the transaction, however cases can extend up to 540 days and even beyond that with certain card companies. The key for a successful chargeback, however, is to file the request with your bank as soon as possible.

It is difficult to accurately ascertain how long it will take for a successful chargeback as each case is different and there are many variables that determine the final outcome. Generally speaking, the chargeback process can take anywhere from 4 – 6 months. This time frame could be shorter when dealing with a simple case and slightly longer when dealing with more complicated cases.

Banks generally do not charge a fee when raising a chargeback dispute as this service is included in the terms and conditions of the contract between the cardholder and the credit card companies.

As the chargeback process is highly complicated and technical, many people contract fund recovery companies that have the necessary skills and experience to present the correct evidence to the banks and credit card companies.

The best chance to successfully win a chargeback dispute is to present a valid claim, know your rights as a consumer, familiarize yourself with the chargeback codes and understand the very complicated and nuanced chargeback process.

The best chance to successfully win a chargeback dispute is to present a valid claim, know your rights as a consumer, familiarize yourself with the chargeback codes and understand the very complicated and nuanced chargeback process.

A credit card chargeback is a bank-initiated transaction reversal for goods (or services) made on a credit card. If the merchandise (or service) was defective or differs from what was originally advertised, then the cardholder has the right to dispute the transaction via their bank as opposed to directly with the merchant.

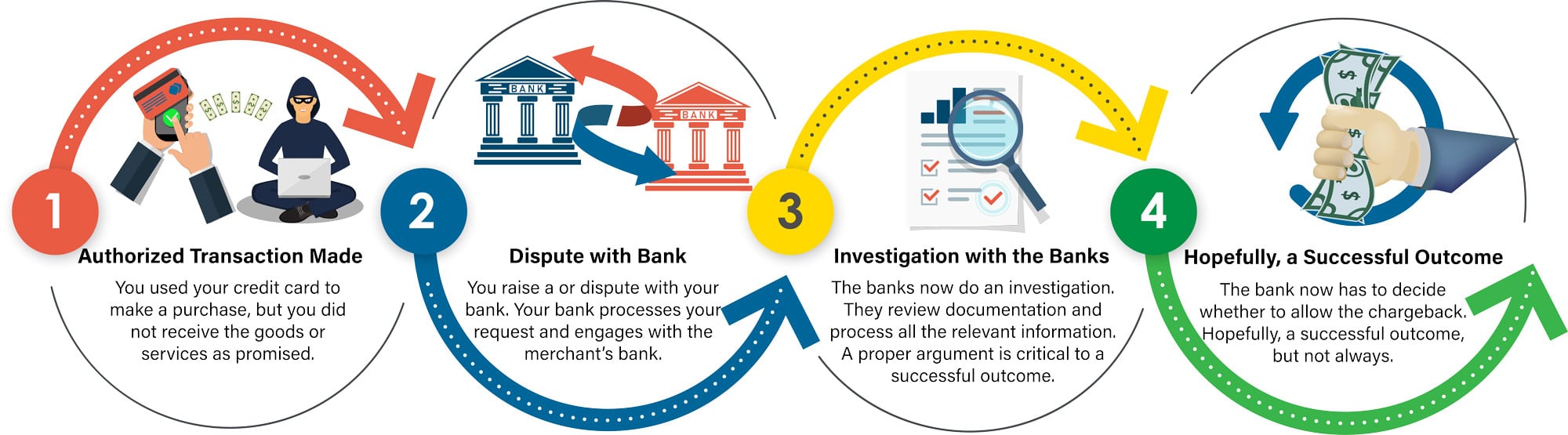

Consider the following diagram:

Chargebacks work by filing a dispute with the appropriate department at the bank and understanding the very complicated and nuanced chargeback process.

The basic steps to the chargeback process are as follows:

- Customer disputes a transaction

- Issuing bank reviews the dispute

- Dispute is escalated to the acquiring bank

- Acquiring bank reviews the dispute and forwards it on to the merchant

- Merchant receives the chargeback dispute, reviews and either accepts or rejects the dispute

- Acquiring bank reviews the merchant’s response and any evidence submitted and forwards it on to the issuing bank

- Issuing bank reviews this evidence and makes a decision whether to accept or reject the chargeback request

- The cardholder and merchant are notified of the final decision

A bank chargeback is a bank-initiated transaction reversal for goods (or services) made on a credit card. If the merchandise (or service) was defective or differs from what was originally advertised, then the cardholder has the right to dispute the transaction via their bank as opposed to directly with the merchant.

Click here to leave your details and we will contact you to walk you through the process.

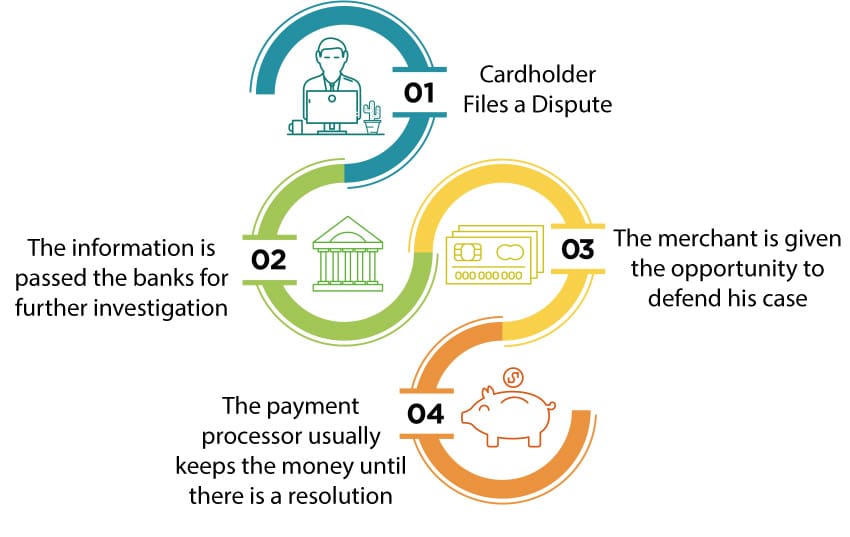

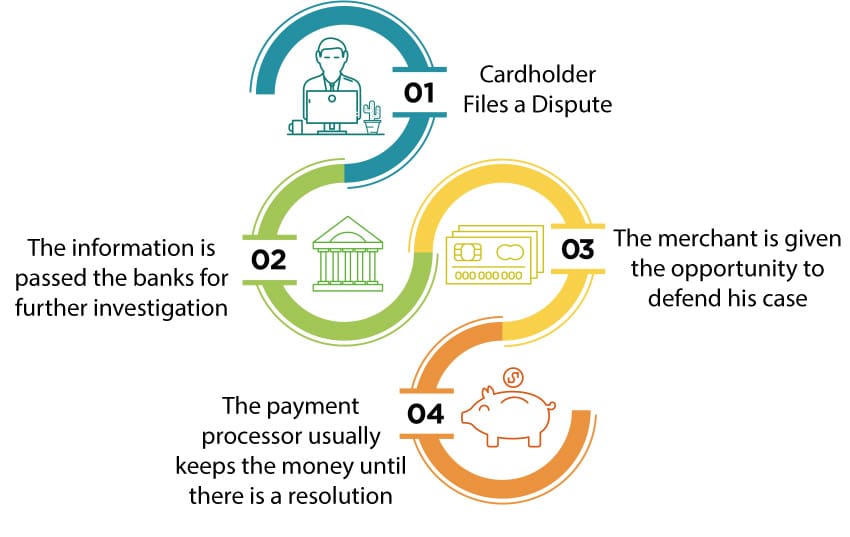

Consider the following diagram:

Chargebacks work by filing a dispute with the appropriate department at the bank and understanding the very complicated and nuanced chargeback process.

The basic steps to the chargeback process are as follows:

- Customer disputes a transaction

- Issuing bank reviews the dispute

- Dispute is escalated to the acquiring bank

- Acquiring bank reviews the dispute and forwards it on to the merchant

- Merchant receives the chargeback dispute, reviews and either accepts or rejects the dispute

- Acquiring bank reviews the merchant’s response and any evidence submitted and forwards it on to the issuing bank

- Issuing bank reviews this evidence and makes a decision whether to accept or reject the chargeback request

- The cardholder and merchant are notified of the final decision