When you make a payment or money transfer via Credit card and the goods or services you received were defective or not as advertised, then you are eligible for a chargeback.

How Does a Credit card Chargeback Work?

A chargeback is essentially a transaction reversal undertaken to dispute a card transaction and to secure a refund for the purchase.

The chargeback process involves your bank (issuing bank) withdrawing funds that were previously deposited into the merchant’s account (acquiring bank) and depositing it back into your account.

The merchant may dispute a chargeback with the bank if it can prove the chargeback is invalid.

How to get a Chargeback on Credit card

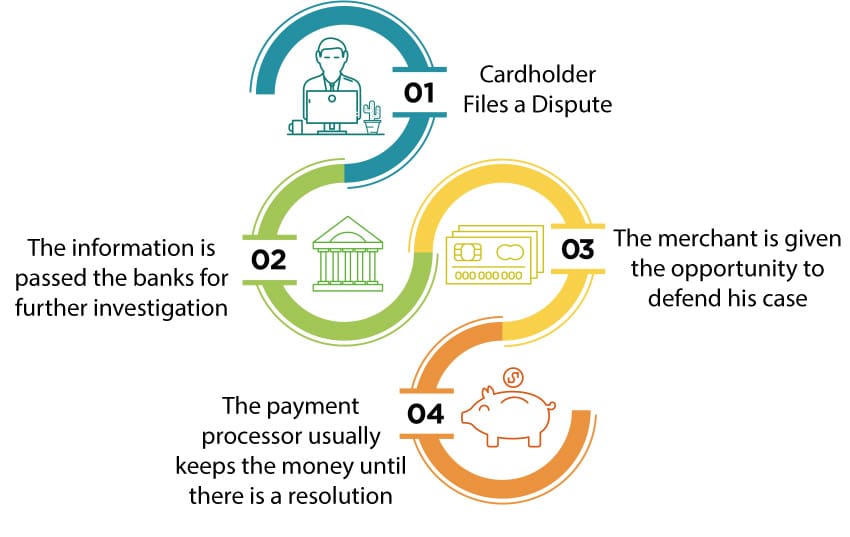

In order to initiate a Credit card chargeback, you will need to contact your payment processor and file a dispute. Start by identifying the transaction under dispute and the reason you’re challenging it.

The information included in the dispute case is sent to the merchant’s card processor and then to the merchant under question. The merchant has the opportunity to accept the request and refund the transaction or defend the chargeback. Should the merchant decide to defend the transaction, they will need to send supporting evidence that it was a valid transaction. The merchant generally has a specified period of time in which to respond, failing which they will lose the dispute.

While the dispute process is underway Credit card may choose to refund the money or hold onto until a decision is reached.

If you have been scammed and are in need of an effective and professional fund recovery solution, contact MyChargeBack today! Simply fill out the form below and we will contact you to discuss your case and provide the best possible solutions to recover your funds.