A credit card charge is when the card is ‘charged’ to make a purchase. In simple terms, a ‘chargeback’ is the reversal of the charge. In other words, a chargeback is when the payment made via a credit card is reversed.

Credit cards have been around since the 1970s, and have various rules and regulations governing their use and which also allow for consumer rights and protections. The following list of keywords will help clarify the process:

Cardholder: The holder of the card used to make a purchase; i.e. the consumer.

Card-issuing bank: The financial institution or other organization that issued the credit card to the cardholder. This bank bills the cardholder for repayment and bears the risk in the event that the card is used fraudulently.

Merchant: The individual or business accepting credit card payments for products or services sold to the cardholder.

Acquiring bank: The financial institution accepting the payment for products or services on behalf of the merchant.

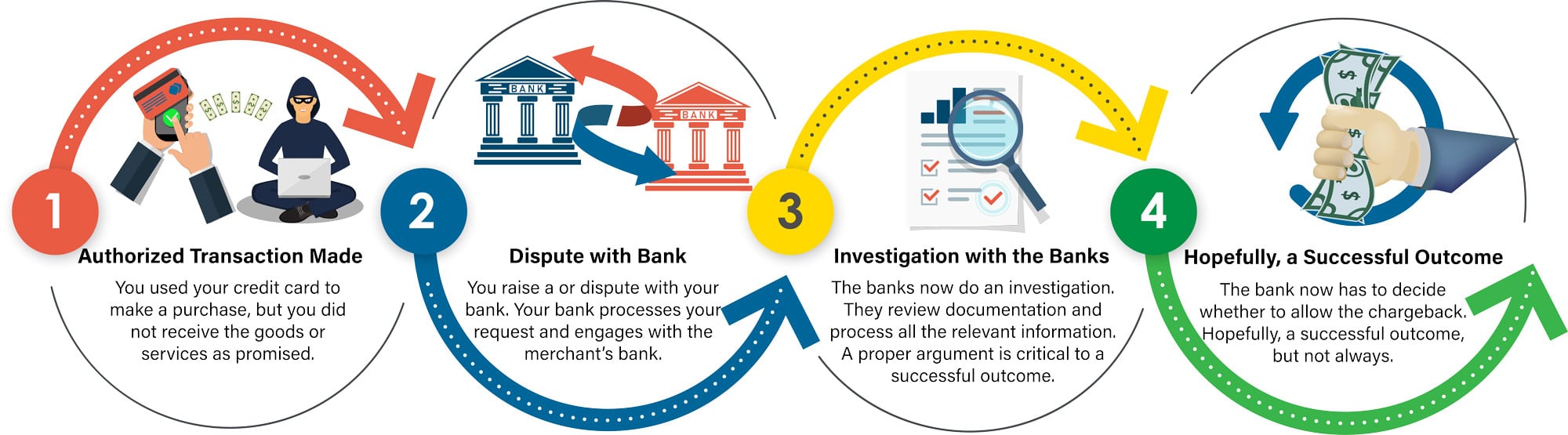

More precisely: a chargeback is an event in which money in a merchant account is held due to a dispute relating to the transaction. Chargebacks are typically initiated by the cardholder. In the event of a chargeback, the issuer returns the transaction to the acquirer for resolution. The acquirer then forwards the chargeback to the merchant, who must either accept the chargeback or contest it.

When the cardholder initiates a chargeback, there is a process that involves a complex dispute resolution dynamic between the cardholder and the merchant where the card-issuing bank and the acquiring bank become involved in the dispute. The complexity arises when the cardholder and merchant cannot come to an agreement.

The difficulty in chargebacks arises also in the confusion surrounding the reason codes credit card companies like VISA and MasterCard use to describe chargebacks. For stolen credit cards, the usage is fraud and these are usually handled by a different department in a bank. For service-related transactions, the technical aspects of the transaction were authorized by the cardholder legitimately, rather the service was not rendered – the merchant was at fault at failing to provide the services/goods as promised.