How to Initiate a Frenninge Sparbank (Sweden) Chargeback in 2021

Although the chargeback process appears simple and straightforward, it is important to fully understand the steps, requirements and various stakeholders involved. Incorrect information can result in a denied Frenninge Sparbank (Sweden) chargeback. Remember that you have one chance at submitting a chargeback and all your information needs to be 100% accurate.

Who are the Participants in the Chargeback Process?

- Cardholder / Customer

The cardholder is the owner of the bank card that was used in the transaction which is under dispute. The customer is the individual who was directly involved in the transaction. Generally, the cardholder and customer are the same person, but this is not always the case.

- The Merchant

The merchant is the individual or company who sold the product or service to the customer. When the Frenninge Sparbank (Sweden) chargeback dispute is raised, the merchant is notified and either accepts the claim or chooses whether to dispute it.

- The Issuing Bank

The issuing bank is the bank or financial institution that issued the card to the cardholder.

- The Acquiring Bank

The acquiring bank is the bank that holds the merchant’s account that accepts credit and debit card transactions and payments.

- The Credit Card Company

The credit card company is the organization that owns and supplies the credit card. It is the credit card company that determines the terms and conditions relating to credit card transactions that are carried out by the issuing bank. Major credit card companies include VISA, Mastercard, American Express and Discover.

How to File a Chargeback | Frenninge Sparbank (Sweden)

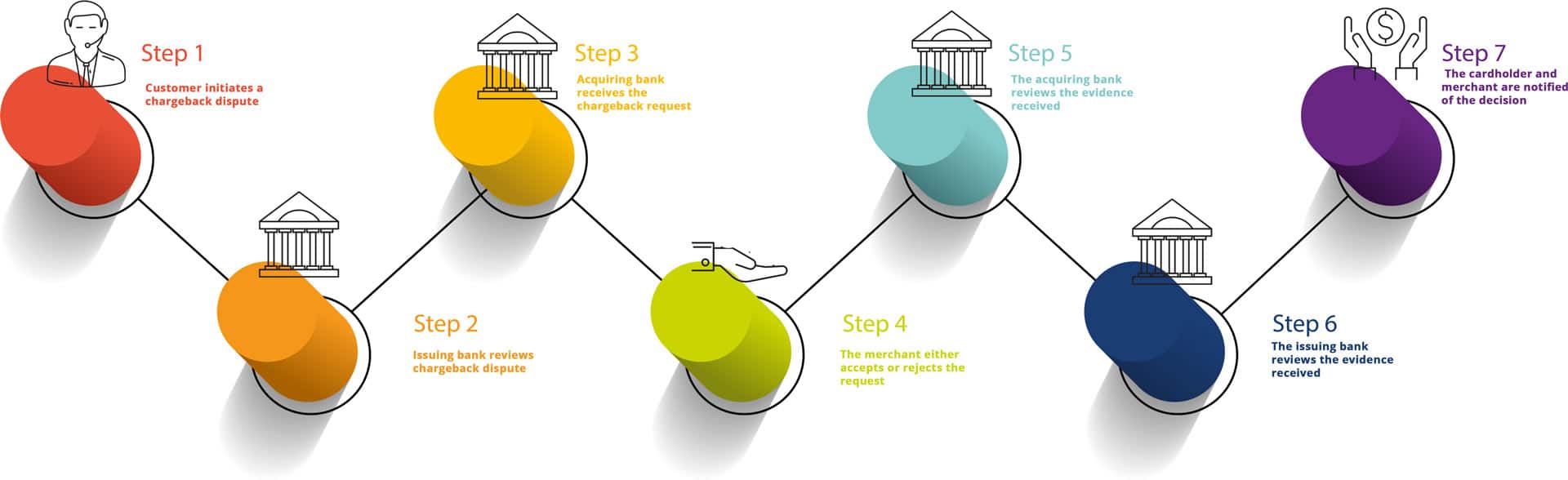

The chargeback process may seem like a simple enough task, the problem is ensuring that all the information presented in your case is accurate, factual, and follows Frenninge Sparbank (Sweden)’s rules and regulations. The list of steps below illustrate how to initiate a Frenninge Sparbank (Sweden) chargeback.

Step 1 – The customer initiates a chargeback dispute request over a transaction.

Step 2 – The issuing bank reviews the chargeback dispute charge and electronically sends the transaction to the acquiring bank

Step 3 – The acquiring bank receives the chargeback request, resolves the issue automatically or forwards it to the merchant

Step 4 – The merchant either accepts the chargeback request or rejects it by sending evidence to the acquiring bank

Step 5 The acquiring bank reviews the evidence received from the merchant, ensures it meets all requirements before sending it to the issuing bank

Step 6 – The issuing bank reviews the evidence received from the merchant and makes a decision on the chargeback request

Step 7 – The cardholder and merchant are notified of the decision where either party can initiate arbitration in the event that they disagree with the decision

Frenninge Sparbank (Sweden) Chargeback Time limit in 2021

How Long Do I Have to File a Chargeback?

Frenninge Sparbank (Sweden)’s chargeback time limit typically depends on the card company’s terms and conditions. Generally, cardholders should advise Frenninge Sparbank (Sweden) within 120 days from the date of the transaction, however, cases can extend up to 540 days and even beyond that with certain card companies. The key for a successful chargeback, however, is to file the request with Frenninge Sparbank (Sweden) as soon as possible.

What is Frenninge Sparbank (Sweden)’s Chargeback Fee?

Many people online ask “what is a chargeback fee?” The simple answer is, there should be no fee associated with raising a chargeback dispute as this service is included in the terms and conditions of the contract between the cardholder and the credit card companies.

As the chargeback process is highly complicated and technical, many people contract fund recovery companies that have the necessary skills and experience to present the correct evidence to the banks and credit card companies.

How Long Does the Frenninge Sparbank (Sweden) Chargeback take?

The entire chargeback process can take anywhere from three to six months. This primarily depends on the chargeback codes related to the dispute. Card companies and merchants, however, have varying time limits.

How to Raise the Frenninge Sparbank (Sweden) Chargeback Successfully

There are a number of steps that can be followed to increase your chances of success.

ADVISE Frenninge Sparbank (Sweden)

As previously mentioned, filing a chargeback as quickly as possible will increase your chances of success. If your request meets the criteria for a chargeback and you have your evidence properly documented, it should be done as soon after the transaction is made and within 120 days of the transaction for the best chances of success.

UNDERSTAND THE PROCESS

The chargeback process is governed by precise guidelines; documentation requirements, deadlines, and chargeback codes. Before you submit your request, ensure you have a proper understanding of the requirements set forth by Frenninge Sparbank (Sweden) and the credit card company.

MAINTAIN ACCURATE RECORDS

Confirm what the exact documentation guidelines are with your credit card company in terms of providing evidence. If your evidence does not conform with these requirements, then your chances of success are very low.

UNDERSTAND THE REASON CODES

There are a number of chargeback request codes that need to be submitted with each chargeback request. It is very important to ensure you have the correct code associated with your chargeback otherwise the request will be denied. Remember that you generally have one chance to issue a chargeback so you need to make sure your documentation and chargeback codes are 100% accurate.

GET CREATIVE

Each chargeback dispute requires a letter explaining and detailing the request. Familiarise yourself with the language and tone used in these letters and investigate which letters provide the best chances of success.

UNDERSTAND THE REGULATIONS

Documentation requirements can vary from one organization to the other as the industry is not standardized. If your documentation and evidence do not comply with Frenninge Sparbank (Sweden) or credit card company requirements, your chargeback request could be denied before it is even reviewed.

Conclusion

The chargeback process outlined above is a simplistic model of how the entire process works. There are many variables that apply to each individual case and it is of utmost importance to understand what needs to be presented to Frenninge Sparbank (Sweden) and the rules and regulations that go with it.

If you are dealing with a relatively large sum of money and want to improve your chance of success, it would be a good idea to consider hiring a professional firm that understands the chargeback process and has a proven track record of success.

We work very closely with a company called MyChargeBack that brings with it years of experience in dealing with chargeback disputes with hundreds of banks worldwide.

MyChargeBack will analyze your chargeback dispute and determine the most appropriate argument and evidence to present to Frenninge Sparbank (Sweden).

If you are in need of an effective and professional fund recovery solution, contact MyChargeBack today! Simply fill out the form below and we will contact you to discuss your case and provide the best possible solutions to recover your funds.